By using our website, you agree to the use of cookies as described in our Cookie Policy

Multiple Employer Plan 401k Solutions for Small Business Success

Retirement plan management designed for small businesses

Experience the Retail401K difference with affordable, professionally managed 401k plans built for small businesses and retail owners nationwide. As a Multiple Employer Plan (MEP) provider, we enable small companies to offer competitive retirement benefits while reducing administrative burden and controlling costs.

- Easy Setup - Get your plan launched quickly with guidance every step of the way

- Hands Off Maintenance - We handle compliance, filings, and day-to-day administration

- Low Cost - Enjoy institutional-level pricing specifically for small business budgets

Small businesses should have access to the same retirement plan infrastructure as larger organizations—that's what we deliver.

Joining A Multiple Employer Plan Has Its Advantages

A strong retirement benefit program can help businesses of all sizes gain a competitive edge to attract and retain talent—but it can also mean added costs and responsibility.

A multiple employer plan 401k (MEP) may be an attractive option for organizations seeking to ease the administrative burden, reduce fiduciary liability, and lower the expense while still offering a quality retirement plan.

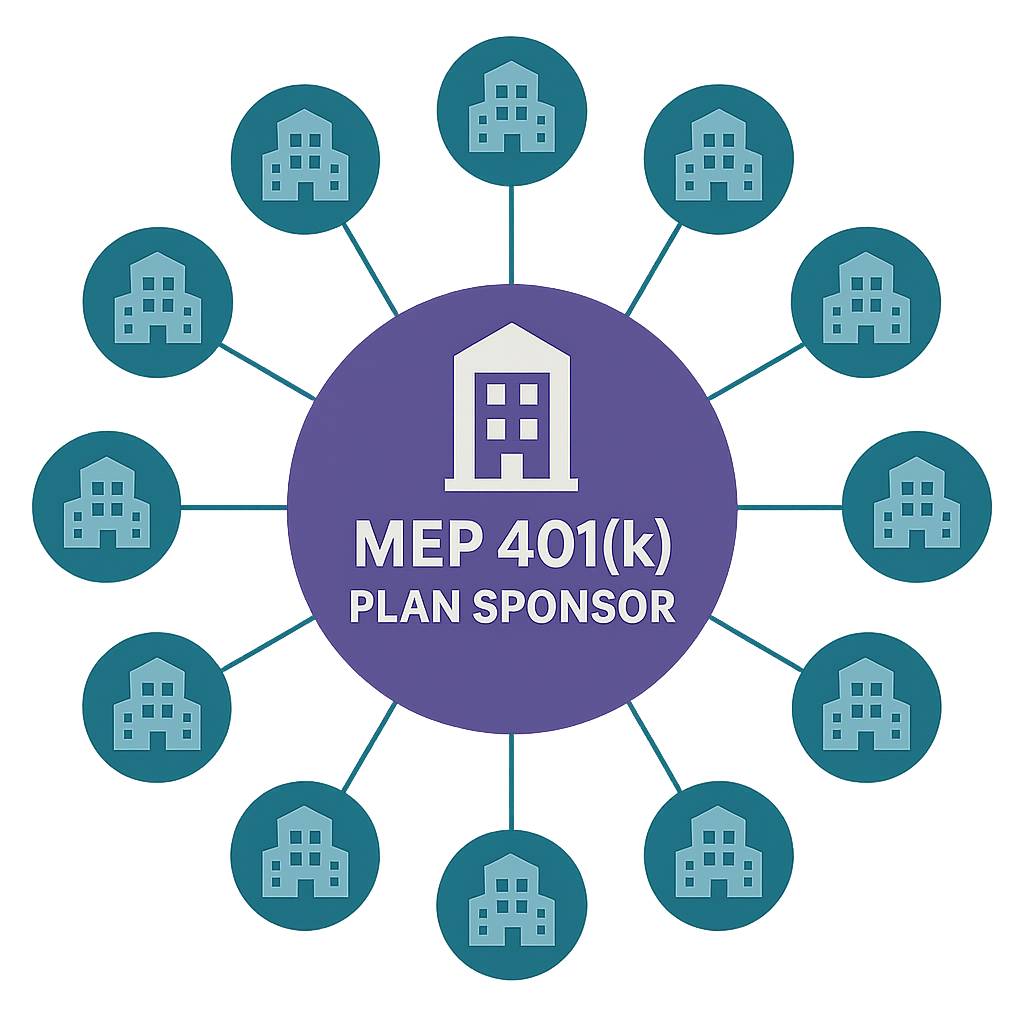

WHAT IS A MEP?

A MEP is a retirement plan sponsored by one entity for unrelated organizations that share a common business interest.

HOW IT WORKS

- The MEP sponsor is the "lead" plan and can serve as the plan administrator and fiduciary

- Adopting employers elect to join the MEP

- At any time, adopting employers are easily integrated into the plan hosted by the sponsor and tracked on the Transamerica platform

Most importantly, the MEP sponsor is responsible for handling the administrative and fiduciary responsibilities related to your retirement plan, so you can focus on what matters most: running your business.

Why Multiple Employer Plans Work for Small Businesses

- Administrative relief, as the MEP sponsor and a professional service team take over the majority of day-to- day tasks

- Reduced liability, as fiduciary support and most responsibility is assumed by professional plan administrators

- Ability for adopting employers to retain many of their customized plan features

- Support with investment selections and performance oversight

- Access to participant communications and plan education support

- Time savings for organizations by offloading many plan-related tasks

- Potential cost savings compared to operating a single employer plan

Simplify Your 401(k) Planning with Our Small Business Pricing Tool

Take the guesswork out of setting up a 401(k) for your business. Our Small Business 401(k) Pricing Tool makes it easy to get a clear, customized quote for your Retail401K MEP plan—tailored to your company’s size and goals. In just a few clicks, you can compare costs, explore plan options, and see how we help businesses offer competitive retirement benefits without the hassle or high fees.

What Our Clients Are Saying About Us

Stay Connected With Retail401K

Associations We Support

Retail401k Provides Multiple Employer 401k Plans for Businesses Owners Across the United States, Including:

- Florida

- Illinois

- Maine

- Massachusetts

- New Hampshire

- New York